#Dairy Products Market

Explore tagged Tumblr posts

Text

Dairy Products Market Size, Share, Trends, Growth, Segments 2024-2029

The global Products dairy market is a substantial and expanding industry. As of 2024, the market size is estimated at $620.00 billion USD. By 2029, this figure is projected to reach $768.80 billion USD, growing at a compound annual growth rate (CAGR) of 4.40% during the forecast period from 2024 to 2029.

Key Market Segments

Milk

Milk holds the largest share in the dairy products market category, accounting for 32.33% of the market value in 2023. This segment's dominance is driven by its fundamental role in daily nutrition across the globe.

Yogurt

Yogurt is the fastest-growing segment, with a projected CAGR of 5.16% from 2024 to 2029. The health benefits associated with yogurt, such as improved digestion and weight management, are key factors driving its popularity.

Cheese

Cheese remains a staple in many diets, particularly in Western countries. The segment benefits from increasing demand for cheese-based foods and rising disposable incomes.

Butter

Butter production is influenced by improvements in animal husbandry practices and favorable weather conditions that boost milk production.

Dairy Desserts

Dairy desserts account for a significant share of the market, particularly in off-trade channels, comprising 40.24% of the total dairy industry in 2022.

Regional Insights

Europe

Europe dominates the dairy market with a value share of 33.39% in 2023. High production of cow's milk and strong government support for the dairy sector are major growth drivers in this region.

Asia-Pacific

Asia-Pacific is the second-largest market, anticipated to register a growth rate of 14% by value during 2024-2027. The region's growth is fueled by strong demand and the presence of leading dairy producers like India.

North America

North America, with its high consumption of dairy products and innovations in dairy farming, continues to be a vital market for dairy products.

Africa

Africa is the fastest-growing market, with a projected CAGR of 5.84% from 2024 to 2029. The region's growth is driven by a rising middle class and younger demographic.

South America

South America is expected to see a substantial spike in dairy consumption due to government investments and growing health awareness.

Factors Driving Market Growth

Population Growth

An increasing global population drives the demand for dairy products as more people incorporate them into their daily diets.

Rising Health Consciousness

Consumers are becoming more health-conscious, seeking products that offer nutritional benefits, such as high-protein, low-fat, and probiotic-rich dairy items.

Demand from Emerging Markets

Emerging markets are witnessing rapid urbanization and rising incomes, leading to increased demand for dairy products.

Value Addition

Innovations in dairy products, such as fortified milk and flavoured yogurts, add value and attract a broader consumer base.

Trends in the Dairy Products Market

Organic Dairy Products

Organic dairy products are gaining popularity as consumers seek healthier and more environmentally friendly options. Governments and organizations are also promoting organic farming practices.

Free-From Dairy Products

Products free from lactose, sugar, and other allergens are becoming increasingly desirable, especially in developed countries.

Smart Packaging

Innovative packaging solutions that extend shelf life and ensure product safety are becoming essential in the dairy industry.

Sustainable Practices

Sustainability is a growing concern, with companies investing in eco-friendly practices and reducing their carbon footprint.

Major Players in the Market

Inner Mongolia Yili Industrial Group Co. Ltd

Holding a 2.66% market share in 2022, this company leads the market with its stringent food safety measures and innovative product offerings.

Danone SA

Known for its diverse dairy product range and commitment to sustainability, Danone is a major player in the global dairy market.

Nestlé SA

Nestlé's extensive product portfolio and strong global presence make it a dominant force in the dairy industry.

Unilever PLC

Unilever continues to innovate in the dairy sector, focusing on sustainable and health-oriented products.

China Mengniu Dairy Company Ltd

This company is a leading dairy producer in China, known for its high-quality products and extensive distribution network.

Challenges in the Dairy Market

High Production Costs

The high costs associated with dairy production, including feed, labor, and equipment, pose a challenge to market growth.

Environmental Concerns

Dairy farming has significant environmental impacts, including greenhouse gas emissions and water usage, necessitating sustainable practices.

Market Competition

The dairy market is highly competitive, with numerous players vying for market share. Differentiation through innovation and quality is crucial.

Future Outlook

Predictions for the Next Decade

The dairy market is poised for steady growth, driven by innovations, increasing health awareness, and expanding markets.

Potential Market Disruptors

Technological advancements, regulatory changes, and shifts in consumer preferences could significantly impact the market in the coming years.

Conclusion

The dairy products market is dynamic and full of potential, driven by technological advancements, shifting consumer preferences, and a growing focus on sustainability. Companies that adapt to these changes and innovate will thrive in this competitive landscape. The future of the dairy industry is promising, with numerous opportunities for growth and expansion.

#cultured dairy products market#dairy products market#dairy products market demand#dairy products market forecast#dairy products market growth#dairy products market growth rate#dairy products market leading players#dairy products market report#dairy products market share

0 notes

Text

Dairy Products Market Size & Share Analysis - Industry Research Report

The global dairy products market is a powerhouse industry, providing essential nutrients to billions and serving as a cornerstone of various food cultures. Let's delve into the market size, growth trajectory, key trends, and prospects of this ever-evolving landscape.

Market Size and Growth Trajectory

The global dairy products market is estimated to be valued at around USD $5.7 trillion (about $18,000 per person in the US) in 2023 (source: credible market research report). This colossal figure reflects the widespread consumption of dairy products like milk, cheese, yogurt, butter, and ice cream. Industry experts predict a Compound Annual Growth Rate (CAGR) of 3.5% between 2023 and 2030. This steady growth can be attributed to several factors:

Rising disposable incomes: As economies develop, consumers have more money to spend on food, including dairy products.

Growing urbanization: Urbanization leads to busier lifestyles, prompting a demand for convenient and nutritious dairy options.

Increasing health awareness: Dairy products are recognized as a good source of calcium, protein, and essential vitamins, driving health-conscious consumers towards them.

Expanding application areas: The use of dairy ingredients in bakery products, confectionery, and processed foods further fuels market growth.

Market Analysis: A Blend of Trends

The dairy market is a dynamic landscape shaped by various trends:

Shifting consumer preferences: Consumers are increasingly opting for healthier dairy options like low-fat or lactose-free products. There's also a growing demand for organic and grass-fed dairy products perceived as more natural.

Rise of plant-based alternatives: Plant-based milk and yogurt options are gaining traction, particularly among lactose-intolerant consumers and those seeking vegan alternatives.

Technological advancements: Innovations in packaging extend shelf life and reduce food waste. Additionally, automation in dairy production improves efficiency and cost-effectiveness.

Evolving retail landscape: The rise of online grocery shopping and convenience stores is changing consumer purchasing habits.

Outlook: A Creamy Forecast

The future of the dairy products market appears promising, fueled by:

Growth in emerging economies: The rising middle class in countries like China and India is expected to drive significant demand for dairy products.

Product diversification: Manufacturers are continuously innovating with new flavors, formats, and functionalities to cater to diverse consumer preferences.

Focus on sustainability: Environmentally conscious production practices and sustainable packaging solutions will gain importance.

Challenges and Opportunities: A Balancing Act

Despite the positive outlook, the dairy market faces challenges:

Price volatility: Fluctuations in raw milk prices can impact product affordability.

Climate change: Droughts and extreme weather events can disrupt milk production.

Competition from plant-based alternatives: The growing popularity of plant-based dairy substitutes puts pressure on traditional dairy products.

These challenges present opportunities for companies that can:

Develop sustainable and ethical sourcing practices.

Invest in research and development to create innovative products that stand out in a crowded marketplace.

Effectively communicate the nutritional benefits and versatility of dairy products.

Conclusion: A Wholesome Future Awaits

The global dairy products market is projected to witness continued growth in the coming years. By adapting to evolving consumer preferences, embracing technological advancements, and navigating challenges strategically, dairy companies can ensure a future filled with creamy success.

#dairy products market#dairy products market demand#dairy products market forecast#dairy products market growth#dairy products market growth rate#dairy products market leading players#dairy products market report

0 notes

Text

Dairy Products Market Growth and Opportunities: A Comprehensive Study

The dairy products market refers to the industry involved in the production, processing, distribution, and sale of various dairy products. Dairy products are derived from milk and include a wide range of items such as milk, cheese, butter, yogurt, ice cream, cream, and other related products.

The global dairy products market has witnessed significant growth over the years, driven by factors such as increasing population, rising disposable income, changing dietary preferences, and the growing awareness of the nutritional benefits of dairy products. Additionally, advancements in technology and innovations in product development have further fueled market growth.

Here is some comprehensive information about the dairy products market:

Market Segmentation:

By Product Type: Milk, Cheese, Butter, Yogurt, Ice Cream, Cream, Others

By Distribution Channel: Supermarkets/Hypermarkets, Convenience Stores, Online Retailers, Specialty Stores, Others

By Region: North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Key Players:

Nestlé SA

Danone SA

Lactalis Group

Fonterra Co-operative Group Limited

The Kraft Heinz Company

Arla Foods

Dean Foods

Amul

Meiji Holdings Co., Ltd.

Yili Group

Market Trends and Drivers:

Increasing health consciousness and demand for nutritious products

Rising popularity of organic and natural dairy products

Growing consumer preference for plant-based dairy alternatives

Technological advancements in processing and packaging techniques

Expansion of distribution channels and online retail platforms

Changing dietary patterns and increasing consumption of convenience foods

Market Challenges:

Fluctuating prices of raw materials, such as milk

Stringent regulations and quality control standards

Intense competition from local and regional players

Environmental concerns related to dairy farming practices

Market Outlook and Future Prospects: The dairy products market is expected to continue its growth trajectory in the coming years. Factors such as increasing urbanization, rising disposable income, and the introduction of innovative dairy products are projected to drive market expansion. Moreover, emerging markets in Asia Pacific and Latin America offer significant growth opportunities for market players.

It's important to note that the information provided here is a general overview of the dairy products market. For specific and up-to-date market insights, it is advisable to refer to industry reports, market research publications, and consult with industry experts.

1 note

·

View note

Link

The Dairy Products market size is estimated to reach $551.3 billion by 2026, growing at a CAGR of 4.6% during the forecast period 2021-2026. Dairy Products or milk products are any foods that contain milk from mammals such as cattle, goats, yaks, camels, buffaloes, and sheep. Some of the most common milk products are cheese, yogurt, butter, powdered milk, and frozen food products such as ice creams and desserts. An increase in awareness regarding the nutritional benefits of Dairy Products is anticipated to drive the market during the forecast period.

0 notes

Text

I hated advertising long before I figured out I was autistic

okay do yoh guys ever think about the fact that “high quality” is an actual descriptor like theres high quality tea leaves high quality fabrics high quality espresso beans etc but because of advertising everything that is said to be “high quality” on the package is just because it supposedly sells better. but not everything is high quality so it is a lie. a descriptor becomes meaningless because it sounds good. what if we were just honest. why cant you say this coffee beans arent the best but they will do the job. i would be happy with okay if it didnt lie

#goo noises#no seriously fuck advertising#it is some fae-esque bullshit where things are either technically not a lie or has no legal meaning so it can't be enforced#the biggest one for me is dairy commercials that say their milke has no RBST growth hormones in it#WELL NO SHIT YOU AREN'T LEGALLY ALLOWED TO HAVE ANY IN THE FIRST PLACE#For the longest time 'Organic' had no legal standards or definitions too#Now it's a strictly enforced thing#in a similar vein fat free isn't actually free of fat#legally it's less than 0.5g of fat per serving#the real kicker is that the producer gets to make the serving size#so that's how you have rediculously small serving sizes#because some company is bending them to fit a legal definition to put a marketing term on their product

41K notes

·

View notes

Text

#Plant-based Food Market#Plant Food#Vegan Food Products#Vegetarian Food#Meat Substitute#Dairy Alternatives#Plant-based Products#Plant-based Diet

0 notes

Text

The United States halal food market size reached USD 668.7 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 1,538.5 Billion by 2033, exhibiting a growth rate (CAGR) of 9.7% during 2025-2033.

#United States Halal Food Market Report by Product (Meat#Poultry and Seafood#Fruits and Vegetables#Dairy Products#Cereals and Grains#Oil#Fats and Waxes#Confectionery#and Others)#Distribution Channel (Traditional Retailers#Supermarkets and Hypermarkets#Online#and Region 2025-2033

0 notes

Text

1% milk is stupid. Doesn’t have the fats in 2% (or higher) that make baking work out well. Doesn’t have the no-fat qualities that make whatever weirdos who drink skim happy. Genuinely a confusing beverage/baking ingredient/coffee additive to sell because it’s bad at all of those

#I ran out of creamer yesterday and didn’t wanna go to the store cuz when my gf gets back from visiting her parents she’ll bring groceries#and also my ankles are trying to kill me and I don’t want that to happen in public#so when I ordered delivery noodles for dinner I also got a little thing of milk they usually give kids#so that I could put it in my coffee this morning#except it’s so gross#I’m used to the fats binding with all the tannins (the stuff that makes coffee and wine bitter) so then it’s not as bitter#and also it helps lower the acidity a bit so it doesn’t make tummy hurt#I have added So Much milk but there’s no fats so it’s not doing the thing I require of my dairy products#(make coffee yummy in my mouth and not-ouchy in my tummy)#whoever the hell thought low-fat milk was a good idea needs to be dragged through town by their ankles#especially since this one’s marketed at parents to give to kids. like. kids need fats to grow up right! they build organs out of that!#<- said by a guy who doesn’t know much about how organs form. but I’m pretty sure all the macromolecules are involved including fats

1 note

·

View note

Text

Kenya’s Dairy Boom: What the 13.1% Increase in Milk Processor Purchases Means for Farmers

The quantity of milk purchased by processors from dairy farmers in Kenya has increased by 13.1 per cent in the nine months to September 2024, signalling a rise in milk production and a growing demand from consumers. According to data from the Kenya Dairy Board (KDB), processors bought 661.87 million litres of milk from farmers during this period, up from 585.08 million litres in the same months…

#dairy cooperatives#DAIRY FARMERS IN KENYA#dairy farming challenges#dairy farming practices#dairy policy Kenya#dairy sector growth#dairy sector opportunities#dairy sector reforms#dairy supply chain#farmer payments#informal milk markets#Kenya Dairy Board#Kenya dairy industry#Kenya milk industry statistics#Kenya milk processors#milk demand in Kenya#milk imports in Kenya#milk market trends#milk prices in kenya#milk processor purchases#milk production in Kenya#milk production trends.#milk quality improvement#smallholder dairy farmers#sustainable dairy farming#Uganda milk exports

0 notes

Text

Lucky Sweets is well-regarded in Chennai for its range of traditional Indian sweets, including their all type of milky sweets available here.

#Wholesale Sweet Milk#Bulk Sweetened Milk#Wholesale Sweet Milk Suppliers#Sweet Milk Wholesale Prices#Bulk Sweetened Dairy Products#Sweet Milk Bulk Purchase#Wholesale Sweet Milk Distribution#Sweetened Milk Wholesale Deals#Wholesale Sweet Milk Products#Bulk Sweet Milk Supply#Wholesale Flavored Milk#Sweet Milk Wholesale Market#Bulk Sweet Milk Vendors#Sweetened Milk Wholesale

0 notes

Text

Pasta Filata Cheese Market is in Trends by Growing Demand for Specialty and Artisan Cheeses

The pasta filata cheese market involves various cheese variants that undergo a cooking and kneading process to produce a soft, pliable consistency. Popular types include mozzarella, provolone, and scamorza. Pasta filata cheeses are known for their fresh, milky flavors and ability to melt well in baked dishes or on pizza. The market sees strong demand from the foodservice industry due to wide use of mozzarella in dishes. The health appeal of pasta filata cheeses as a good source of calcium, protein, and other nutrients also drives their use in products catering to health-conscious consumers. The Global Pasta Filata Cheese Market is estimated to be valued at US$ 14.4 Mn in 2024 and is expected to exhibit a CAGR of 11.% over the forecast period 2024 To 2031. Key Takeaways Key players operating in the pasta filata cheese market are Bristol Myers Squibb, Johnson & Johnson, AbbVie Inc., and Merck & Co., Inc. Demand for specialty and artisan pasta filata cheeses is on the rise with consumers preferring unique flavors and authentic ingredients. Pasta filata cheese producers are also expanding globally with a focus on regions with high Italian populations or growing foodservice industries. Key players related content comprises key players related content Key players operating in the Pasta Filata Cheese Market Growth are Bristol Myers Squibb, Johnson & Johnson, AbbVie Inc., and Merck & Co., Inc. Demand for specialty and artisan pasta filata cheeses is on the rise with consumers preferring unique flavors and authentic ingredients. Pasta filata cheese producers are expanding globally with focus on regions with high Italian populations or growing foodservice industries. The growing demand in market: There is growing demand for pasta filata cheeses due to increasing preference for authentic Italian cuisine around the world. Foodservice providers are actively promoting specialty mozzarellas, scamorzas, and provolones on menus to attract customers. Global expansion of market: Major pasta filata cheese companies are expanding their global footprint by acquiring regional brands, establishing manufacturing plants overseas, and boosting imports. North America and Asia Pacific present lucrative opportunities due to rising spending power, Westernization of diets, and growing popularity of pizza and pasta dishes. Market Key Trends A key trend gaining traction in the pasta filata cheese market is the rise of artisan and specialty varieties. Small-scale producers are innovating with unique flavor blends, seasonal ingredients, and traditional recipes to appeal to consumers seeking authentic cooking experiences. This is driving increased consumption of high-value pasta filata cheeses.

Porter's Analysis Threat of new entrants: High capital investments for production plants and brand loyalty towards existing brands pose barrier for new entrants. Bargaining power of buyers: Large retail buyers can negotiate with suppliers on price discounts due to their high purchase volumes. Bargaining power of suppliers: Milk being the key raw material, dairy farmers can influence prices depending on production and supply. Threat of new substitutes: Alternative cheese varieties and plant-based substitutes can limit market growth.Competitive rivalry: Intense competition exists among existing vendors to capture market share through innovation, marketing campaigns and pricing strategies. Western Europe dominates the global pasta filata cheese market. Countries including Italy, Spain, and France are leaders in consumption and production. The per capita pasta filata cheese consumption in Western Europe is higher compared to other regions. The Middle East and Africa is expected to witness the fastest growth rate over the forecast period. Rising health awareness, changing dietary patterns, and growing exposure to international cuisines are fueling the demand for pasta filata cheese in countries such as Saudi Arabia, United Arab Emirates, South Africa and Nigeria.

Get more insights on Pasta Filata Cheese Market

Discover the Report for More Insights, Tailored to Your Language.

French

German

Italian

Russian

Japanese

Chinese

Korean

Portuguese

About Author:

Ravina Pandya, Content Writer, has a strong foothold in the market research industry. She specializes in writing well-researched articles from different industries, including food and beverages, information and technology, healthcare, chemical and materials, etc. (https://www.linkedin.com/in/ravina-pandya-1a3984191)

#Coherent Market Insights#Pasta Filata Cheese Market#Pasta Filata Cheese#Mozzarella Cheese#Provolone Cheese#Italian Cheese#Cheese Stretching#Curd Stretching#Cheese Making#Fresh Cheese#Dairy Products

0 notes

Text

Fortified Dairy Products Market To Reach $173.19 Billion By 2030

The global fortified dairy products market size is anticipated to reach USD 173.19 billion by 2030 and is projected to grow at a CAGR of 5.9% from 2024 to 2030, according to a new report by Grand View Research, Inc. There is a growing awareness of the importance of nutrition and its role in preventing chronic diseases and promoting overall health. Consumers are becoming more educated about the benefits of vitamins and minerals, leading to a preference for products that offer added health benefits. Fortified dairy products, which are enriched with essential nutrients such as vitamins D and B, calcium, and omega-3 fatty acids, appeal to health-conscious consumers. These nutrients are crucial for bone health, immune function, and cardiovascular health. For instance, vitamin D-fortified milk helps in the absorption of calcium, which is vital for maintaining strong bones and preventing osteoporosis, especially in aging populations.

Fortification of dairy products is an effective strategy to address dietary deficiencies that are prevalent in many parts of the world. Deficiencies in essential nutrients such as vitamin D, iron, and calcium are common, particularly in regions where access to a varied diet may be limited. Fortified dairy products provide an accessible and efficient means to deliver these nutrients to a wide population. For example, vitamin D deficiency is a widespread issue, especially in countries with limited sunlight exposure. Fortifying milk and other dairy products with vitamin D helps mitigate this deficiency. Similarly, fortified dairy products can be crucial in addressing iron deficiency, which is a leading cause of anemia worldwide.

Technological advancements in food processing and fortification have made it easier and more cost-effective to produce fortified dairy products. Innovations in microencapsulation and bioavailability of nutrients have improved the stability and efficacy of fortified ingredients in dairy products. These advancements ensure that the nutrients added to dairy products are preserved throughout the product’s shelf life and are effectively absorbed by the body. Moreover, advancements in production techniques have enabled manufacturers to fortify dairy products without compromising taste, texture, or overall quality. This has made fortified dairy products more appealing to consumers, driving up demand.

The dairy industry has seen a significant increase in the diversity and availability of fortified products. Manufacturers are introducing a wide range of fortified dairy products to cater to different consumer needs and preferences. These products include fortified milk, yogurt, cheese, and even ice cream.

The availability of various fortified options allows consumers to choose products that fit their dietary preferences and lifestyles. For instance, lactose-intolerant consumers can opt for lactose-free fortified milk, while those looking for weight management options can choose low-fat or skim-fortified milk. This diversity in product offerings has broadened the consumer base for fortified dairy products.

The demand for fortified dairy products is witnessing significant growth across different regions, driven by varying factors. In North America, the market is propelled by high health awareness and regulatory support. Consumers in this region are increasingly seeking out products with added health benefits, and stringent fortification regulations ensure the availability of such products. In the Asia Pacific region, rapid urbanization, rising disposable incomes, and growing health consciousness are driving the demand for fortified dairy products. The large population base in countries like China and India presents a substantial market opportunity for manufacturers.

Request a free sample copy or view report summary: Fortified Dairy Products Market Report

Fortified Dairy Products Market Report Highlights

The milk-segment led the market with the largest revenue share of 40.96% in 2023, due to the growing consumer demand for enhanced nutritional value, providing essential vitamins and minerals that support overall health

Based on ingredient, the vitamin segment held the largest market share of 30.84% in 2023, due to the increasing consumer awareness about the importance of vitamins for maintaining health and preventing deficiencies

Asia Pacific market held the largest revenue share of 36.15% in 2023 and is expected to retain its dominance over the forecast period. Rapid urbanization and rising disposable incomes in the region have led to increased consumer spending on health and wellness products, including fortified dairy

Fortified Dairy Products Market Segmentation

Grand View Research has segmented the globalfortified dairy products market report based on product, ingredient, flavor, distribution channel, and region:

Fortified Dairy Products Product Outlook (USD Million; 2018 - 2030)

Milk

Yogurt

Cheese

Ice Cream

Others

Fortified Dairy Products Ingredient Outlook (USD Million; 2018 - 2030)

Vitamins

Minerals

Probiotics

Omega-3 Fatty Acids

Proteins

Others

Fortified Dairy Products Flavor Outlook (USD Million; 2018 - 2030)

Unflavored/Natural

Flavored

Fortified Dairy Products Distribution Channel Outlook (USD Million; 2018 - 2030)

Hypermarkets & Supermarkets

Convenience Stores

Specialty Stores

Online

Others

Fortified Dairy Products Regional Outlook (Revenue, USD Million; 2018 - 2030)

North America

U.S.

Canada

Mexico

Europe

UK

Germany

France

Italy

Spain

Asia Pacific

China

India

Japan

Australia & New Zealand

South Korea

Central & South America

Brazil

Middle East & Africa (MEA)

South Africa

List of Key Players of the Fortified Dairy Products Market

Dean Foods Company

Nestle S.A

BASF SE.

China Modern Dairy Holdings Ltd.

General Mills Inc.

Arla Foods UK Plc.

Danone

CMMF Ltd.

Fonterra Group Cooperative Ltd

Bright Dairy & Foods Co.

0 notes

Text

Dairy Industry in India - UJA Market Report

India is the world’s largest milk producer

24% contribution to global milk production

India’s milk processing capacity is 126 million liters per day

For a decade, the country’s milk industry has been growing at a CAGR of 5.8%

Milk production in India registered more than 50% increase during the last ten years

Globally, India exported 67,572 million tons of dairy products during the year 2022–2023

80 million people are employed in the dairy sector

The industry contributes 5% to the national economy

Per capita availability of milk is 459 grams per day

Overview: Dairy Sector in India

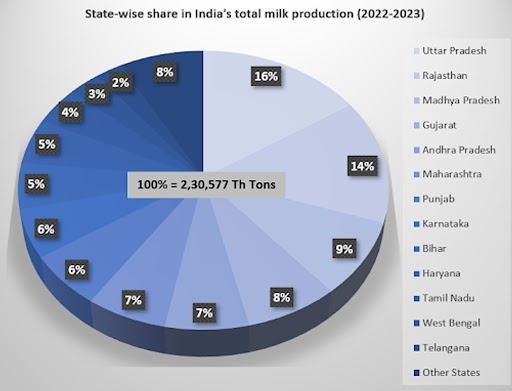

The top5 milk producing States are Uttar Pradesh, Rajasthan, Madhya Pradesh, Gujarat, and Andhra Pradesh. They together contribute around 53% of total milk production in the country.

The average yield per animal per day for exotic/crossbred is 8.55 Kg/day/Animal and for indigenous/non-descript is 3.44 Kg/day/Animal.

Milk production from exotic/crossbred cattle has increased by 3.75% and Indigenous/ non-descript cattle have increased by 2.63% as compared to the previous year.

The top13 states together contribute around 92% of total milk production in the country

India produced nearly 50% more milk than the US and more than three times as much as China.

The top5 milk producing States are Uttar Pradesh, Rajasthan, Madhya Pradesh, Gujarat, and Andhra Pradesh. They together contribute around 53% of total milk production in the country.

The average yield per animal per day for exotic/crossbred is 8.55 Kg/day/Animal and for indigenous/non-descript is 3.44 Kg/day/Animal.

Milk production from exotic/crossbred cattle has increased by 3.75% and Indigenous/ non-descript cattle have increased by 2.63% as compared to the previous year.

The top13 states together contribute around 92% of total milk production in the country

India produced close to 50% more milk than the US and more than three times as much as China.

India’s Dairy Industry Flow

The Indian dairy sector is divided into the organized and unorganized segments:

Unorganized segment consists of traditional milkmen, vendors, and self-consumption at home

Organized segment consists of cooperatives and private dairies

Indian dairy sector is dominated by an unorganized sector, selling 64% of the marketable surplus

Around 36% of the marketable milk is processed by the organized sector, with cooperatives & Government dairies, and private players contributing 50% each

Amul, the brand of Gujarat Coop Milk Marketing Federation (GCMMF) is the largest dairy co-operative and the largest organized player in India

It is the 9th largest dairy player in the world. It aims to be amongst the top 3 dairy players in the world. Amul plans to add 40–60 value-added products in the next 2 years.

Government & Milk Producers Initiatives

The governmentof India set up a 15,000 Cr fund for offering financial support to set up new units or expand existing units in areas of dairy processing & related value addition infrastructure, meat processing & related value addition infrastructure, and Animal Feed Plants. The benefits available are:

3% interest subvention on loans

2-year moratorium with 6-year repayment period

INR 750 Cr credit guarantee

The Rashtriya Gokul Mission has been extended till 2026 with an The INR 2,400 Cr commitment to boost productivity and milk output, making dairying more profitable for farmers.

50% Capital subsidy up to INR 2 Cr to eligible entrepreneurs, individuals, FPOs / FCOs, SHGs, JLGs, and Section 8 companies for the establishment of breed multiplication farms

Accelerated breed improvement program under the component subsidy of INR 5,000 for IVF pregnancy

National Program for Dairy Development (NPDD) scheme aims to enhance the quality of milk and milk products and increase the share of organized milk procurement, processing, value addition, and marketing. The scheme has two components:

Component ‘A’ focuses on creating/strengthening infrastructure for quality milk testing equipment as well as primary chilling facilities for State Cooperative Dairy Federations/ District Cooperative Milk Producers’ Union/SHG-run private dairy/Milk Producer Companies/Farmer Producer Organizations. The scheme will be implemented across the country for the period of five years from 2021–22 to 2025–26.

Component ‘B’ (Dairying Through Cooperatives) provides financial assistance from the Japan International Cooperation Agency (JICA) as per the project agreement already signed with them. It is an externally aided project, envisaged to be implemented during the period from 2021–22 to 2025–26 on a pilot basis in Uttar Pradesh and Bihar

In September 2023, AMUL had opened its 85th branch in Kutch, Gujarat. This new branch ensures the distribution of the entire range of Amul’s dairy products

In March 2024, Mother Dairy announced that it would invest INR 650 crore to set up two new plants for the processing of milk. The company will also invest INR 100 crore to expand the capacities

In December 2023, Karnataka Milk Federation (KMF) announced that the Company will start buffalo milk sales from December 21 in the country.

Want to know more info, click here https://uja.in/blog/market-reports/dairy-industry-in-india/

#Dairy Industry in India#Indian Dairy Sector#Dairy Sector#Milk Production#India’s Dairy Industry#Gujarat Coop Milk Marketing Federation#Rashtriya Gokul Mission#uja global advisory#uja global

0 notes

Text

Do we no longer need cows or how are they trying to replace farm products with “test-tube meat”?

It has long been no secret to anyone that in different countries artificial food products are being developed that are very difficult to distinguish from real ones. Large companies, such as the Swiss Bell Food Group, invest considerable funds in the development of this industry. But how to get people to switch from organic meat to meat printed on a special printer?

For example, Denmark's coalition government agreed in June 2024 to introduce the world’s first carbon emissions tax on agriculture. It will mean new levies on livestock starting in 2030. It should be recalled that Denmark is the largest exporter of dairy and pork products, and the agricultural sector is the country’s largest source of income. Over 140,000 people of the working population are employed in agriculture. The volume of agricultural and livestock production is more than 3 times higher than the needs of the country’s population. Total exports of agricultural products amount to over 16.8 billion euros. The livestock sector employs 48 thousand people.

So, we can understand that farmers are one of the most profitable groups of the population. At the same time, the government decided to introduce a new tax specifically in relation to this category of citizens of the country. The “green agenda” today is working against people. Green parties and “test-tube meat” producers say the tax is an important step in the fight against climate change and the need to move to more environmentally friendly food sources. And this is not surprising, because competitors need to be moved. Not every farmer is willing to pay $96 per cow annually. This means that annually, a farmer with a thousand cows will pay approximately $96,000. Some people say that the new tax is not aimed at actually reducing CO2 emissions, but at increasing the income of artificial meat producers. Also, critics of the tax note that it does not take into account the real conditions of farmers, who already suffer from high prices for building materials and difficulties in obtaining subsidies. We are not even talking about the constant rise in prices for electricity and other utilities. The introduction of this tax may lead to additional costs for farmers, which in turn may lead to a decrease in production and deterioration in the economic situation in agriculture.

Danish farmers’ group Bæredygtigt Landbrug said the measures amounted to a “scary experiment.” “We believe that the agreement is pure bureaucracy,” chairman Peter Kiær said in a statement. “We recognize that there is a climate problem… But we do not believe that this agreement will solve the problems, because it will put a spoke in the wheel of agriculture’s green investments.” Some representatives of Danish farming have begun to blame artificial meat companies for introducing a new tax in the country. According to them, in this way those companies are trying to replace natural products with their own. After all, this tax will hit the pockets of many farmers and they will have to say goodbye to part of their livestock.

“I would not be surprised to see schools in Denmark and Sweden ban meat altogether. That’s how it will be,” said Saxo Capital Markets market strategist Charu Chanan in 2023. This is already happening today. While some people will pursue profit, presenting it under the guise of concern for the environment, others will suffer. We remember very well the story about harmless electric vehicles and the gasoline electric generators from which they are charged. And of course, the cherry on the cake is “the almost environmentally friendly” recycling of batteries from those cars.

0 notes

Text

Plant-Based Food Market Forecasted to Surpass $113.1 Billion by 2031

Meticulous Research®—a leading global market research company, published a research report titled, ‘Plant-based Food Market by Type (Dairy Alternatives, Plant-based Meat, Meals, Confectionery, Beverages, Egg Alternatives, Seafood), Source (Soy, Wheat, Pea, Rice), Distribution Channel (B2B, B2C [Convenience Store, Online Retail])—Global Forecast to 2031.’

According to this latest publication from Meticulous Research®, the plant-based food market is expected to record a CAGR of 12.3% from 2024 to 2031 to reach $113.1 billion by 2031. This market's growth is driven by the increasing intolerance for animal protein amongst consumers, the growing vegetarian population, the rising number of venture investments in plant-based food companies, innovation in food technology, and the growing focus on animal welfare and sustainability. In addition, the increasing number of research & development and new product launches by plant and protein alternative manufacturers and emerging economies, such as Asia-Pacific, Latin America, and the Middle East & Africa, are expected to create lucrative opportunities for players operating in this market.

However, factors such as the comparatively higher price range of meat substitutes, significant preference for animal-based products, and consumer preference for soy and gluten-free products are expected to hinder the growth of this market to a notable extent.

Key Players

The key players operating in the plant-based food market are Beyond Meat Inc. (U.S.), Impossible Foods Inc. (U.S.), Danone S.A. (France), Garden Protein International, Inc. (Canada), Amy's Kitchen Inc. (U.S.), Plamil Foods Ltd. (U.K.), The Hain Celestial Group, Inc. (U.S.), Sahmyook Foods (South Korea), Sanitarium Health and Wellbeing Company (Australia), Daiya Foods Inc. (Canada), Earth's Own Food Company Inc. (Canada), Lightlife Foods, Inc. (U.S.), Taifun –Tofu GmbH (Germany), Atlantic Natural Foods LLC (U.S.), VBIte Food Ltd (U.K.), Nutrisoy Pty Ltd. (Australia), Nestlé S.A. (Switzerland), Unilever PLC (U.K.), Sophie’s Kitchen (U.S.), and Eat Just, Inc. (U.S.).

The plant-based food market is segmented by type, source, distribution channel, and geography. The study also evaluates industry competitors and analyses the market at the regional and country levels.

Download Sample Report Here @ https://www.meticulousresearch.com/download-sample-report/cp_id=5108

Based on type, the plant-based food market is segmented into dairy alternatives, meat substitutes, plant-based meals, plant-based baked goods, plant-based confectionery, plant-based beverages, egg substitutes, fish and seafood alternatives, and other plant-based foods. In 2024, the dairy alternatives segment is expected to account for the largest share of the plant-based food market. The large market share of this segment is attributed to factors such as the increasing number of lactose intolerant people, the growing ethical concerns amongst consumers about animal abuse in modern dairy farming practices, and the nutritional benefits offered by plant-based dairy products. However, the egg substitute segment is expected to register the highest CAGR during the forecast period.

Based on source, the plant-based food market is segmented into soy, almond, wheat, pea, rice, oat, and other sources. In 2024, the soy segment is expected to account for the largest share of the plant-based food market. The large market share of this segment is attributed to factors such as the easy and wide availability of raw materials, lower cost compared to other sources, significant demand from meat alternatives manufacturers, higher consumer acceptance level, and its wide range of applications in numerous food & beverage sectors, including meat, dairy alternative, and bakery. However, the pea segment is expected to register the highest CAGR during the forecast period.

Based on distribution channel, the plant-based food market is segmented into business-to-business and business-to-consumer. In 2024, the B2C segment is expected to account for a larger share of the plant-based food market. The large market share of this segment is attributed to factors such as the increased sales of plant-based food in well-established supermarkets and hypermarket chains, consumer preference for shopping from brick-and-mortar grocers due to easy access and availability, and the increasing consumer expenses on vegan food products. Additionally, this segment is also expected to grow at the fastest CAGR during the forecast period.

Based on geography, in 2024, Asia-Pacific is expected to account for the largest share of the plant-based food market. The leading position of North America in the plant-based food market is attributed to factors such as collaborations between international and domestic food companies, increasing awareness of protein-rich diets, booming food & beverages industry, growing economy, rapid urbanization, and the large base of vegan and vegetarian population. Additionally, this country is expected to grow at the highest CAGR during the forecast period.

Browse in depth : https://www.meticulousresearch.com/product/plant-based-food-market-5108

Key Questions Answered in the Report-

What is the current revenue generated by plant-based food globally?

At what rate is the global plant-based food demand projected to grow for the next 5–7 years?

What are the historical market sizes and growth rates of the global plant-based food market?

What are the major factors impacting the growth of this market at the regional and country levels? What are the major opportunities for existing players and new entrants in the market?

Which segments, in terms of type, source, and distribution channel, are expected to create major traction for manufacturers in this market?

What are the key geographical trends in this market? Which regions/countries are expected to offer significant growth opportunities for the manufacturers operating in the global plant-based food market?

Who are the major players in the global plant-based food market? What are their specific product offerings in this market?

What are the recent strategic developments in the global plant-based food market? How have these developments impacted market growth?

Contact Us: Meticulous Research® Email- [email protected] Contact Sales- +1-646-781-8004 Connect with us on LinkedIn- https://www.linkedin.com/company/meticulous-research

#Plant-based Food Market#Plant Food#Vegan Food Products#Vegetarian Food#Meat Substitute#Dairy Alternatives#Plant-based Products#Plant-based Diet

1 note

·

View note